April 08, 2009

COP and the IMF Playbook

Elizabeth Warren's Congressional Oversight Panel released a critical report on Geither's administration of the TARP so far. So far, he gets a mixed grade - her video is definitely worth a watch.

It is fascinating to see the points of disagreement between members of the oversight panel. Warren clearly wants to prod Geithner to move more quickly to hold bank managers and investors accountable: to identify insolvent banks, change management, and to wipe out shareholders - the "Swedish model". But other COP members Richard Neiman (D) and John Sununu (R) think it is inappropriate to be talking about shuttering insolvent banks in the middle of a liquidity crisis.

If you want to do your own research and read up on the history of bank crises, here's a salient collection of essays from the IMF (thanks to Google Book Search): Bank Restructuring and Resolution. The remarkable thing about the book is how much consensus there seems to be between the economists. They all agree that both liquidity and insolvency need to be addressed - liquidity first, then insolvency next. For example, Frydl and Quintyn write:

Typically, a systemic banking crisis has two principal dimensions that require intervention: first, a liquidity crisis that threatens widespread depositor panic; second, a degree of systemic distress represented by large losses in asset values that have generated widespread insolvency of banks and capital deficiencies. Decisions regarding the liquidity crisis must be taken under pressure in an environment of high uncertainty. After deposits are stabilized, decisions regarding the resolution of failed banks can be taken in a less volatile environment.

It doesn't seem like there is actually much disagreement we need to both inject huge amounts of money, and then close weak banks. But these two types of intervention are opposite of one another, and so the core of the debate is this: is the liquidity crisis over yet?

I agree with Warren that we are done with the liquidity panic, and it is time to start closing the weak banks. We won't be ready to do that fairly, though, until Geithner's stress tests are finished (and there are rumors that the release of the results will be delayed after April 24 to come after Q1 earnings reports). So a little bit of patience is in order.

April 12, 2009

Geithner's China Triumph

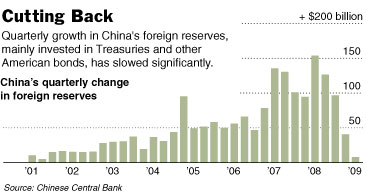

Today NYT notes China's about-face on buying Treasuries. Recall that last November, China had ramped up its purchases of Treasuries to an immensely irresponsible rate of $40b per month, and nobody in Washington seemed to care. Now things have apparently changed. Day to day currency trading is very secretive, but quarterly statistics reveal that China abruptly stopped its destructive dollar-slurping policy when the Obama administration took office. The NYT says that China actually sold Treasuries in January and February.

Today NYT notes China's about-face on buying Treasuries. Recall that last November, China had ramped up its purchases of Treasuries to an immensely irresponsible rate of $40b per month, and nobody in Washington seemed to care. Now things have apparently changed. Day to day currency trading is very secretive, but quarterly statistics reveal that China abruptly stopped its destructive dollar-slurping policy when the Obama administration took office. The NYT says that China actually sold Treasuries in January and February.

April 17, 2009

Death and Taxes

Jess Bachman has published his 2009 edition of "Death and Taxes", a superb visualization of the Federal budget. If you don't feel like reading the full text, the poster is a much more pleasant way to see how the Federal government is spending our tax dollars in 2009.

Remember that this is last budget of the Bush administration - but Bush didn't get it finished so Obama had to pass the previous administration's final appropriations in March.

The 2010 budget is where we see Obama's budget office at work for the first time (headed by super-nerd Exonian-Princetonian-LSE-Marshall-Scholar Peter Orszag). I'd love it if Jess would draw up the 2010 budget compared to Bush's last budget (and compared to Obama's original proposal before going through the Congressional budget process).

April 22, 2009

Poetry and Prose

"You campaign in poetry. You govern in prose." - Mario Cuomo

Obama and Geithner have been busy governing in prose in the last week, preparing for a very complex couple weeks with the release of the bank stress test results. Two pieces of prose worth watching:

Geithner's testimony to Elizabeth Warren's TARP Congressional Oversight Panel.