April 12, 2009Geithner's China Triumph

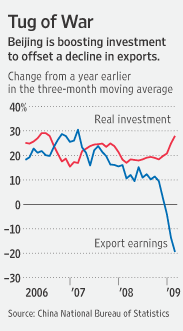

My glance at some U.S. official figures reveals a slowdown but not yet China's reversal. The public Treasury numbers have only been updated up to January; hopefully the NYT is correct that China has started to sell. If it is true that China reversed course and has started to sell Treasuries, it is excellent news for the U.S. economy. Every U.S. dollar China gets by selling Treasuries becomes one dollar of excess Chinese demand for real U.S. goods. That benefits Chinese consumers and American exporters, raises the RMB, and lessens the U.S. trade deficit. And it trains the Chinese to buy from the U.S. over the long run. If China continues a Treasury-neutral or -negative stance permanently (i.e., if protectionism doesn't just stage a return next Christmas), this is all very good news for the trade-imbalanced U.S. The reported about-face of Chinese currency transactions at the beginning of 2009 suggests that Geithner and Obama deserve some of the credit for China's policy change. Remember that during Geithner's nomination, he starkly accused China of being a currency manipulator. He was highly criticized for those words, with the WSJ opining that it is "an especially crazy time [for Geithner] to undermine the dollar." Since then, there has been little evidence of a US currency disaster. But Geithner has continued to negotiate with the Chinese quietly, yet aggressively. Sometimes bits of the negotiation are revealed in public, but Geithner's dramatic success, and China's total reversal, has mostly been kept out of view. China cannot appear to be pushed around by the U.S., nor vice-versa.

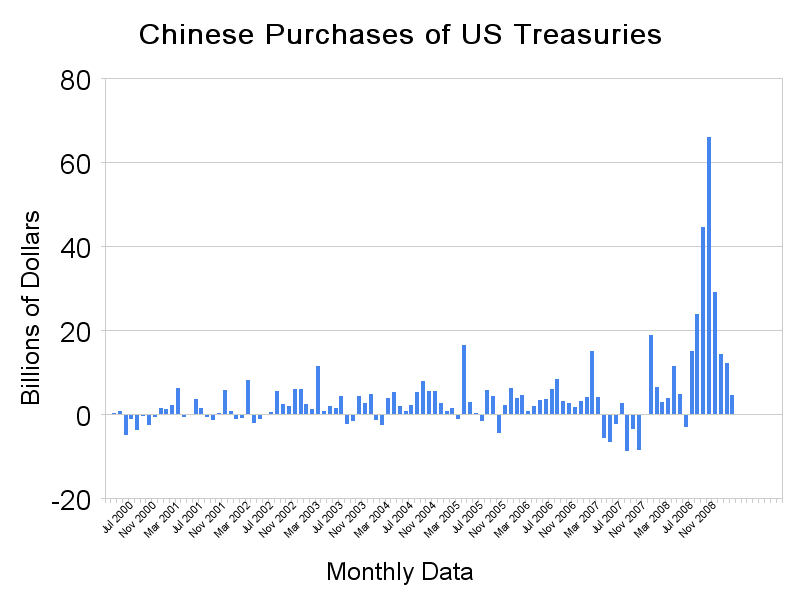

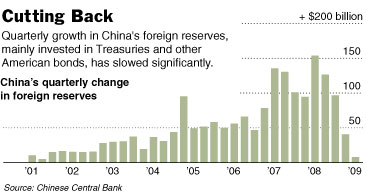

China is playing a very important stabilizing role in this financial crisis we're seeing globally, the things they are doing to get their economy stronger, to encourage domestic demand growth, to allow further evolution in their basic financial framework -- those things are very important, consequential policies, and we're working very, very closely with them. Bravo, Geithner. Hopefully China has what it takes to become permanently trade-balanced. U.S. voters are watching. Update: The reliable Michael Pettis sheds more than a little light on the Chinese foreign reserve numbers and paints a less rosy picture. Basically: dramatic selling in January and February were due to "hot money" exiting China in a panic during the crash. There are reasons for hope that Zhou and Bernanke/Geithner will align, but China is still not doing enough to stimulate domestic demand while whittling down their overcapacity. China needs to be sharing wealth with their consumers, not subsidizing more shipbuilding. Update 2: Marc Chandler puts things in an even less positive light: he believes the decrease in Chinese foreign reserves might actually be due to the devaluation of the Euro rather than any actual selling by the Chinese. We should be watching the U.S. TIC data instead. Update 3: The U.S. Treasury's MFH table is out, and although it verifies China has slowed its huge volumes of Treasury purchases, it has not been a net seller as the NYT assumed. Probably Chandler is right that China's decrease in foreign reserves, when measured in dollar terms, is due to exchange rate changes. I have graphed monthly changes in China's treasury holdings (according to the U.S. Treasury) over the last eight years below.  The picture tells a story not of a long-running trend that needs to be reversed, but of a dramatic and irresponsible move by China to slurp up Treasuries in 2008 in the face of a global financial collapse. That move seems to be coming to an end now. Posted by David at April 12, 2009 02:01 PMComments

Great Article David. I see that China is now buying gold, see here: http://globalbusinessnews.posterous.com/china-reveals-big-rise-in-gold-reserves-0 Also here's another opinion on Geithner that I thought was evenhanded. http://globalitandbusinessnews.blogspot.com/2009/03/in-defense-of-timothy-geithner.html Posted by: kxlsyd at April 29, 2009 01:45 AMPost a comment

|

| Copyright 2009 © David Bau. All Rights Reserved. |

Sometimes in politics and policy you cannot take credit for your victories. But

Sometimes in politics and policy you cannot take credit for your victories. But