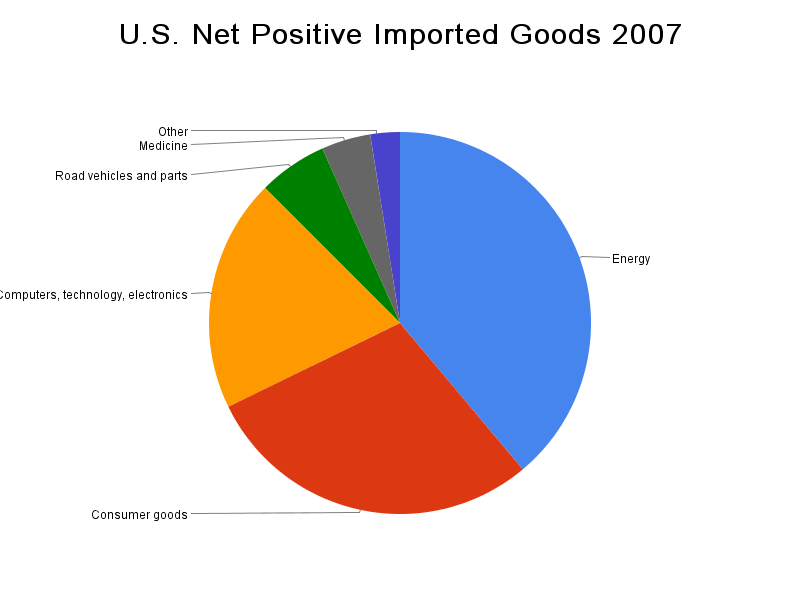

November 06, 2008Helicopters and ImportsThe financial collapse continues. Banks are still too scared to open their own coffers - so shoveling free money to banks (dropping rates, buying debt), is not helping anybody besides bankers. How do we put money into the economy if we cannot tunnel it through banks? Bernanke has famously advocated "Helicopter drops" of money to inject liquidity directly. Back in 2002, he was talking about Japan's deflationary depression, but in 2008 the United States faces the same problem. Since Bernanke is in charge now, some people think that the helicopters are on the way. The Wrong Way To Do A Helicopter Drop Here is how a Bernanke helicopter drop works: the U.S. government offers a massive tax cut across the board. But instead of funding the budget shortfall through the normal offering of government debt to private investors, the money is funded through a special account opened at the Fed which is not backed by any future obligation at all. Helicopter drops are a monetary nuclear option: a way to print money directly. Bernanke envisions a helicopter drop as a major simple tax cut or rebate, but I am not so sure that would work out so well. Handing out stacks of dollar bills to consumers in the face of a Great Depression reminds me of the George W. Bush non-inspirational call to consumers to go on vacation, sports games, and restaurants after the 9/11 attacks. Bush handed out money and told people to go spend it on all-American luxuries. But the problem with 9/11 was that the world did not understand America well enough (and vice-versa) - he should have invested in exporting our ideas and ideals to the undeveloped world, in Arabic language education, and in overseas service. If we had spent the last ten years pursuing a global cultural mission, America would be in a very different place today. Instead, we turned inward and shopped ourselves into today's deplorable debt. Nobody has ever tried helicopter drops in a modern economy before, so we have no road map. But we should not repeat Bush's post-9/11 mistake. Since nobody knows anything, here are my two cents on the right way to do a helicopter drop. A picture of U.S. Imports It seems pretty clear that the fundamental long-term problem with the American economy is that we consume more than we produce. This is equivalent to saying we that spend more than we save. So let's look at where our imbalance is: here is a picture of U.S. imports from 2007. (I rolled up data directly from the U.S. Census website - click for the original links.)  It is a picture of where the American economy is out of balance: we import 321 billion dollars of energy every year. We import a massive amount of consumer goods and electronics. To a lesser extent, we are also big net importers of cars and medicine. If we simply helicopter-drop cash on consumers, then what will happen? We are all consumers, so we know: we will go out and buy a new set of clothes, some Christmas toys, a new flat-screen TV and maybe even a new car. We will drive a little bit faster and a little bit longer. And all those rebate dollars will be sent overseas to Chinese textile and toy factories, Japanese and Korean car and LCD plants, and Middle Eastern oil wells. After a consumer helicopter drop, the rest of the world will see an economic recovery, but we will not. Our prices here in the U.S. will be higher; we will still have high unemployment. We will be facing the return of stagflation, and we will wonder where all the money went. We should drop the money elsewhere. Step One: Global Coordination The first thing to do in a helicopter drop is to avoid worsening trade imbalances. To do this, we need to ask our major trade partners to do the same helicopter drop in their own currencies. The point of printing money is to fight deflation by encouraging inflation. But if we want inflation, we should have global inflation rather than a narrow American dollar devaluation. Obama should be getting on the phone with Canada, China, Japan, and Germany today, and setting up a mechanism to coordinate a global helicopter drop. I think it won't be hard to coordinate a liquidity injection with most countries - all the world economies are suffering and begging for cash. However, there is one exception: I don't know how we will convince the Japanese to hand out money as freely as we do. It goes against the grain of their culture. But if we don't, we will just drive Japanese people to save more as we drive our own people to spend more, worsening the decades-old problem in both of our economies. Step Two: Industrial Investment When we drop cash, we should not drop it on consumers, because even if they do not know it, they will just send the money overseas. That worsens our import imbalance. (Conversely, as exporters, the Japanese and the Chinese probably should drop cash right into consumer pockets.) Instead, in America we should find ways to invest cash in future industrial capacity. We need to build industries to reduce our trade imbalances and right the ship of the economy in the long run. Which industries should get the cash? The import pie chart is a good road map: we should invest first in nonimported energy. A strong domestic energy industry would solve the bulk of the trade imbalance problem all on its own, and perhaps that should be the whole stimulus plan, beginning to end. The chart highlights problems in other areas of course - a stronger automotive industry might help, especially to the extent that new types of cars might reduce our energy consumption - but looking at the raw numbers, we might also want to consider retooling all those carmaking factory workers as electronics factory workers. That is a 164 billion dollar opportunity that is currently being given up to Asia. And what about all our imported consumer goods? My opinion is this: unless we think the future of America lies in a return to the manufacture of clothing and toys, the massive trade imbalance in consumer goods is something that we should probably address by asking consumers spend less on these sort of items rather than spending more. We do not need to pump up the economy by going shopping. We should pump up the economy by doing more productive work instead. Comments

> exporting our ideas and ideals to the undeveloped world You say it as though the under-developed world doesn't have ideas and ideals? Posted by: RichB at November 6, 2008 06:50 AMOf course that is not what I am saying. We are a nation of xenophobic Americans who never travel overseas, who never do work, service, or school overseas, and who cannot read or speak foreign languages. The only way we can export ideals and ideas is to import them in equal measure. That is a different topic from my worry about the helicopter drop, however. We can easily export our cash and import oil and consumer trinkets - we have done that for years, and it is not good for the planet. Before we start printing money, we need to chart a new course. We need to start producing our fair share of the world's goods. Posted by: David at November 6, 2008 07:04 AMThe Australian government recently announced plans to do this. The money will be given to consumers, but in a way that targets particular types of people : pensioners, families with children, people with disabilities, carers, etc. While its always possible that these people will just go and buy imports, I think the reasoning is that they are more likely to spend the money on services, which keeps the money in the country. There are also incentives for building and buying homes, and money will also go into funding training places, and fast-tracking infrastructure projects. http://www.abc.net.au/news/stories/2008/10/14/2390519.htm Here there is no need to "print money" because they are just spending a portion of the existing budget surplus. Of course the plan has been criticised. The numbers have been called arbitrary, and the effects of the stimulus were not formally modelled. I guess in the current climate there's not a lot of certainty, so this sort of "suck it and see" response might not be a bad approach. Posted by: Stewart at November 6, 2008 09:33 AMDavid - how do you propose we produce our fair share of the world's goods? I'm not sure I follow you .. in some ways I think you are talking out of both sides of your mouth. We have out-sourced manufacturing (which I think is to get the lowest costs more than anything) but it does at least get us interacting with the world - not just the US.

A typical middle class American is trying to make ends meet and probably wouldn't have a clue how to export their ideas to the world even if they could find the time and the energy. This is in response to your comment "we are a nation of xenophobic Americans who never travel overseas... etc."

By the way, I left the country in disgust when Nixon was president ... I was in my 20's and spent the next 7 years in Southern Europe. I know many people who have traveled abroad and not just doing a tourist bus thing. I get a feeling that you don't know who you are talking about when you reference "Americans". Posted by: Mary at November 10, 2008 06:03 PMMy wife made me promise that we'd do the same thing (leave the country) if Obama lost - I am not sure we actually would have had the spine to do it. Xenophobic? Hopefully I am wrong. But after 9/11, we sure found it easy to close the nation's doors to the Muslim world after the attacks. The Middle East is changing, and more immigration would have strengthened us and connected us. The immigration policy debate in this country scares me. Today we could respond to high oil prices by cutting gas taxes. We could react to the credit crunch by giving money to banks. But these band-aids, however necessary, are still just ways to hope the world isn't changing. The fact is, the world is changing. Energy is permanently more scarce. Asia has become more like us, and we will become more like Asia. For years excess money has flowed into the U.S. and that has given us the luxury of importing oil and outsourcing our manufacturing. But that tide is reversing. Posted by: David at November 11, 2008 08:23 AMHi David, Great pie chart of US imports! >> I rolled up data directly from the U.S. Census website - click for the original links. Where are the links? I am trying to find a pie chart or data to compare US imports from China and US oil imports. Thanks, Linda Posted by: Linda at November 13, 2010 06:04 PMI got imports and exports from here: http://www.census.gov/foreign-trade/statistics/product/enduse/imports/c0000.html If you click on the pie chart image itself, you can link to the original spreadsheet I used to create the chart. Posted by: David at November 26, 2010 05:35 PMPost a comment

|

| Copyright 2008 © David Bau. All Rights Reserved. |